The Stock Market Has No Idea What’s Coming

Investors are simultaneously terrified that AI works and that it doesn’t

👋 Hey there, I’m Alberto! Each week, I publish long-form AI analysis covering culture, philosophy, and business for The Algorithmic Bridge. Free essays weekly. Paid subscribers get Monday news commentary and Friday how-to guides. You can support my work by sharing and subscribing.

Today I’m delaying the Friday guide because the AI selloff this week is too interesting to let sit until Monday. The guide will go out very soon. Here’s my take on what’s actually happening and why everyone’s analysis is missing the point.

I. THE SAASPOCALYPSE

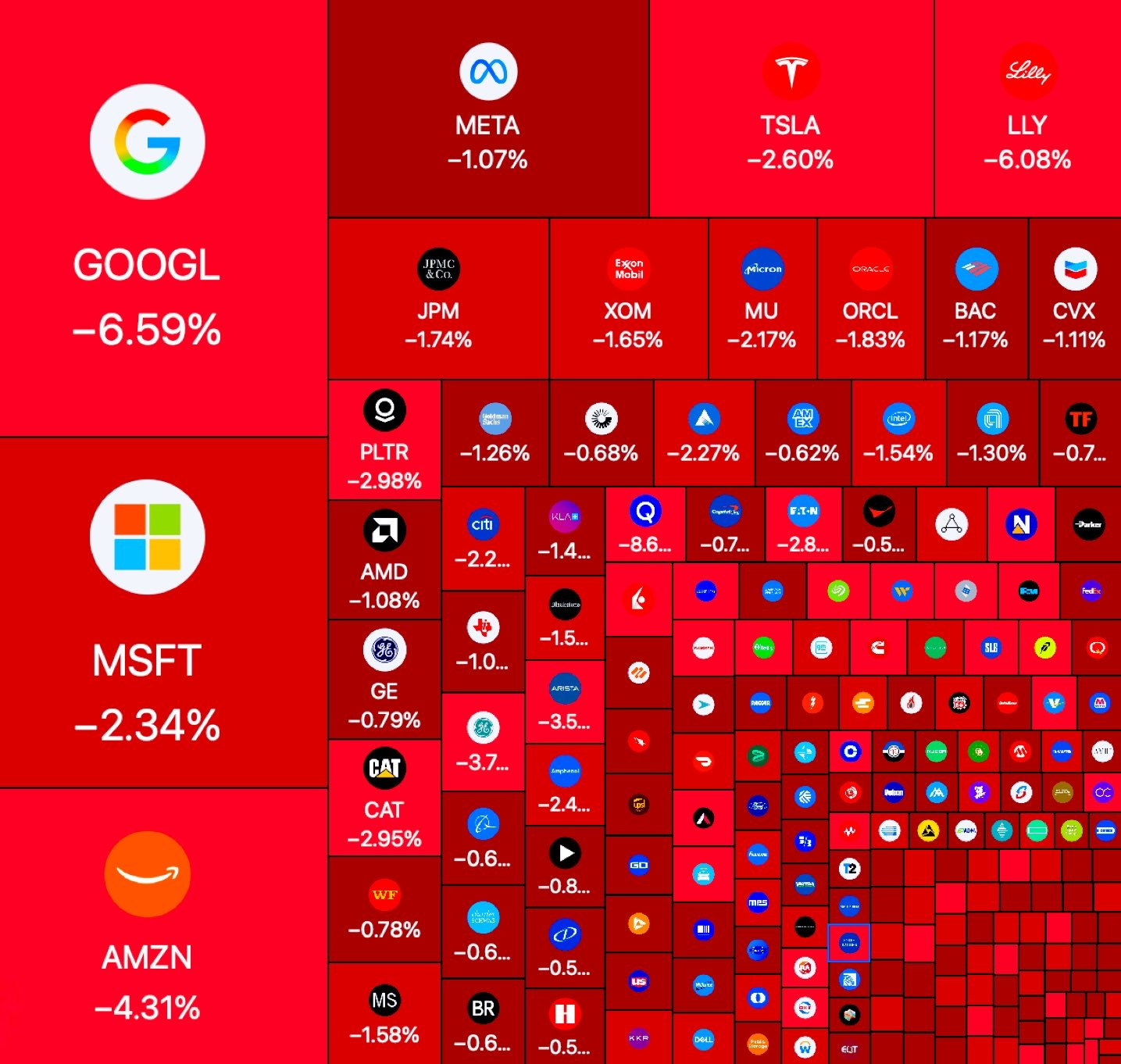

Jefferies has a name for what’s happening to software stocks: the SaaSpocalypse. Since January 28, the S&P 500 software and services index has shed roughly $830 billion in market value. The word on every trading desk, according to Jefferies’ own equity desk, is “get me out.”

The proximate trigger was Anthropic. They released new legal, finance, and marketing capabilities for its Claude Cowork productivity tool—they call Cowork “Claude Code for the rest of your work,” although Claude Code was already for non-coders as well—and open-sourced the plugins.

So AI is finally eating software. LLMs are pushing into the “application layer,” the lucrative enterprise territory where SaaS companies have built their businesses for two decades. It’s not looking good.

Nvidia CEO Jensen Huang called the selloff “the most illogical thing in the world,” because it makes no sense to think that AI agents will invent new software tools when they can use existing ones. But as Keynes said (and has been repeated this week a lot): “Markets can remain irrational longer than you can remain solvent.” Despite the apparent irrationality, the story kind of makes sense: part of SaaS revenues will be redirected to the pockets of AI companies.

But that’s only half the selloff picture. While SaaS stocks collapsed on fears that AI works too well, infrastructure stocks were also collapsing on fears that AI doesn’t work well enough.

Alphabet reported earnings—first ever $400 billion year—and projected $185 billion in AI capital expenditure. The stock fell because the market—we can only speculate here—assumes that’s more than AI will require (especially if the datacenters are financed on debt). Your typical bubble concerns and such. Deutsche Bank said the number “stunned the world.” And indeed, the world was stunned: Microsoft had already dropped about 10% after disappointing cloud services growth. AMD plunged 17%. Nvidia extended its losses for the year. Amazon’s stock tanked (they project $200 billion of AI spending for 2026). Meta projects up to $135 billion. And so on, totaling $650 billion across Big Tech, most of it dedicated to AI infrastructure.

What do all these companies have in common? They either make chips or build datacenters: they’re the backbone of the AI industry. The market’s verdict on AI infrastructure spending is quite clear: Unclear return on excessive investment.

If you now take both pieces of the story and put them together, you realize what’s going on: The market is running two conflicting trades simultaneously. Trade one: AI will destroy software companies, so sell them. Trade two: AI companies are spending too much building AI, so sell them.

And so we’re left with a red week due to an “internally inconsistent” set of beliefs. That’s how Bank of America’s senior analyst Vivek Arya put it, recalling, once again, that infamous Keynes line. If AI is powerful enough to make SaaS companies obsolete, then the hundreds of billions being spent on AI infrastructure are justified (another instance of the Jevons paradox). If the spending is unjustified and the returns aren’t there, then SaaS companies are probably safer than the market thinks.

II. LOGICAL AND RATIONAL

Both fears cannot be true at the same time, right? Arya is right that there’s a contradiction. But calling it “irrational” and “illogical” is where the analysis I’ve read stops short: few people worldwide have truly understood the implications of AI, which are nothing short of illogical.

The market is reacting exactly as a rational entity should, and I will explain why.